Step-by-Step Guide to PIP [Infographic]

According to Florida law, any resident who owns a vehicle must have personal injury protection (PIP) insurance. The purpose of PIP is to cover the cost of injuries and lost wages for the driver no matter who is at fault for the accident. PIP is typically part of the standard auto insurance coverage for residents of the state, yet many people do not know how it really works. Here is a step-by-step guide about personal injury protection insurance that will walk you through how it works in the state of Florida.

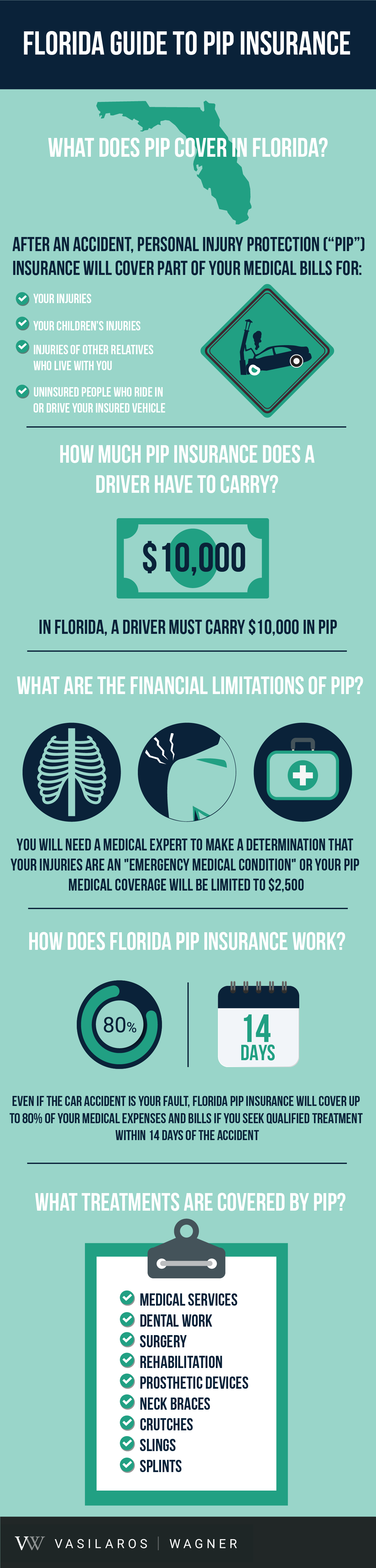

Florida Guide to PIP Insurance Infographic

What Does PIP Cover in Florida?

In the state of Florida, personal injury protection will pay part of your medical bills for your injuries in the event that you are injured in a car accident. This is true whether you were driving or riding in your own car, or driving or riding in another person's vehicle.

If you have relatives who live in your home with you, they can be covered under your PIP policy. Without your permission, individuals who are injured while riding in or driving your insured car can also qualify for benefits. However, if your relative or friend has their own PIP policy, then their insurance company will always be responsible for covering the cost of their injuries.

In certain vehicles, drivers do not need to have PIP insurance for themselves or their passengers. Some examples of these vehicles are:

- Motorcycles

- Limousines

- School Buses

- Taxicabs

- Mobile Homes

- Inoperable Vehicles

- Other Vehicles That Are Not Self-Propelled

A common question that many drivers have is whether they need an attorney to receive their PIP benefits. The purpose of PIP is to protect drivers from the stress of lost wages and unexpected medical bills. However, if your auto insurance company disputes the claim or does not want to pay the full benefits you should be receiving, then you may need the help of a personal injury lawyer.

What Are the Financial Limitations of PIP?

PIP is a necessity in the state of Florida, so there is a minimum amount in terms of how much a driver must carry. In Florida, a driver must carry:

- $10,000 in PIP

- $10,000 in property damage liability

In the event of a serious car accident, you can expect your auto insurance to cover you up to the limit of $10,000 or more for the following:

- Medical Treatments

- Other Damages, Such as Funeral Expenses and Lost Wages

If you find yourself in another auto accident within a few months, your PIP coverage will restart. Essentially, you will receive another $10,000 worth of coverage for the second car accident. The reason for this is that the second car accident is a completely separate and new claim.

When you buy auto insurance coverage, keep in mind that you could face high medical bills and lost wages after a bad car accident. You should also consider that there are financial limitations of PIP. For example, in the event that a medical expert decides your injury is a non-emergency, the PIP coverage for your medical expenses will be limited to just $2,500. In addition, certain treatment options are not covered by PIP, such as massage therapy and acupuncture.

How Does Florida PIP Work?

If you are involved in an auto accident, you will probably need to seek medical attention as soon as possible. Even if the car accident is your fault, Florida PIP insurance will cover up to 80% of your medical expenses and bills if you seek qualified treatment within the necessary timeframe. Treatment that is deemed medically necessary for this purpose are:

- Splints

- Prosthetic Devices

- Neck Braces

- Crutches

- Slings

- X-Rays

- Surgical, Medical, Dental, or Rehabilitative Services

After an accident, you will have two weeks to seek medical treatment if you want your treatment to be covered by PIP. Your insurance company can and will most likely reject your claims if you fail to meet the deadline.

If the insured driver dies in the car accident, their estate will receive $5,000.

Issues with Multiple Claims

If you get into several auto accidents in a year, there are some issues you could face. For example, if you are involved in a serious car accident, your doctor may use up your PIP benefits and then still need to use your health insurance coverage. If you end up in another car accident before the year ends, this could have a negative impact on your insurance. Also, the second car accident can worsen the injuries that you sustained from the first car accident, which can make it hard for physicians to determine the original cause of your injuries.

Due to the many possible issues, it is necessary to work with your doctors and your personal injury lawyer immediately if you find yourself involved in a second accident. By working with them, you will be able to deal with the issues of multiple car accident claims.

Your Personal Injury Lawyer Will Help

PIP insurance is required for drivers in the state of Florida—and for good reason. After a car accident, PIP benefits can make your life a lot easier. For more information about how PIP works in Florida, how to start working with an experienced Florida Car Accident Lawyer, or other questions related to an auto accident, give us a call at 386-777-7777. Our compassionate legal team is here to help.

- $250 Million in Settlements and Verdicts

- Largest Jury Verdict In Volusia County History

- No Cost Unless We Win

- Top Rated Avvo + Google Reviews

- Provide Our Lawyer Guarantee

- 24/7 Personal Injury Support

- Call (833) 333-3333